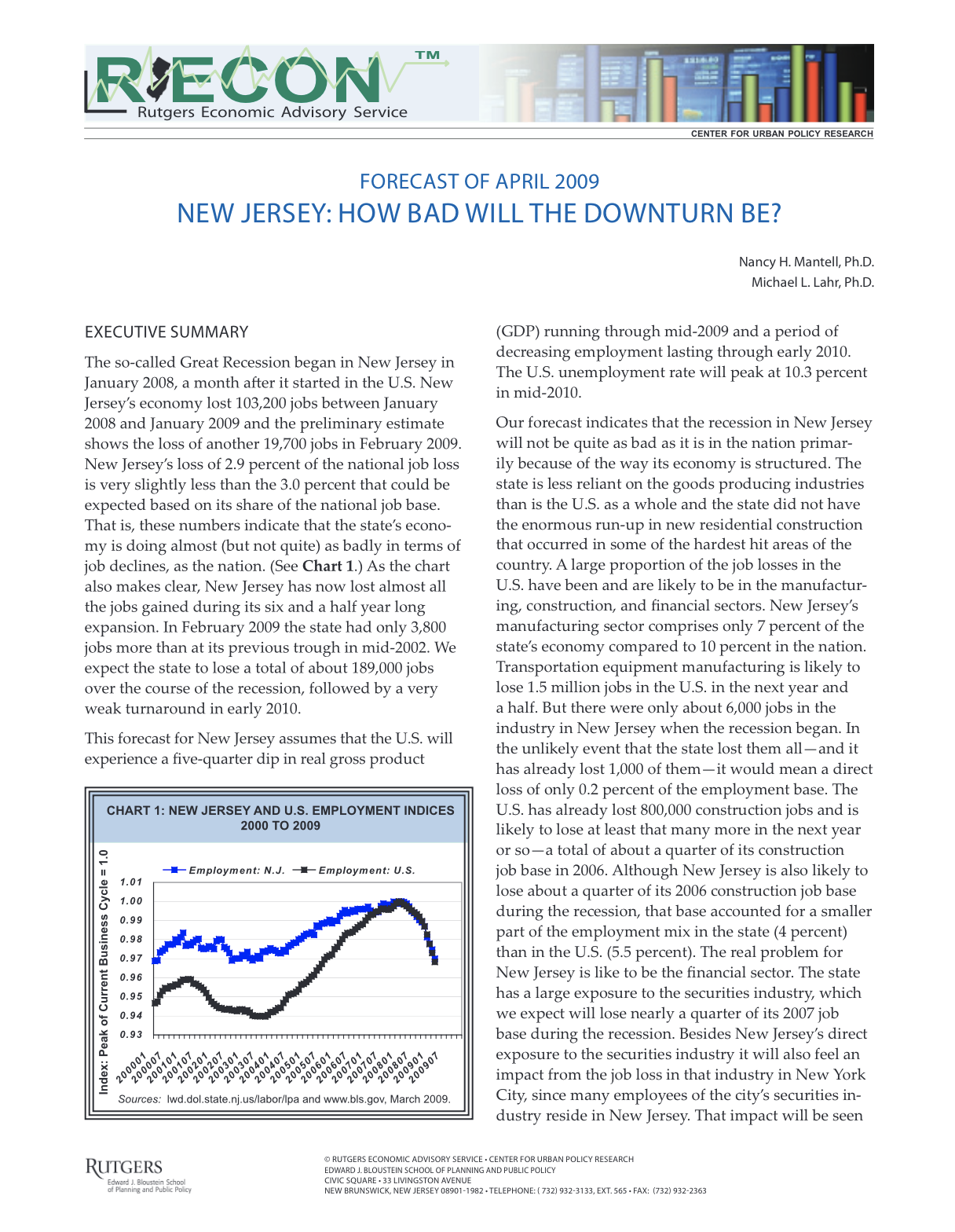

The so-called Great Recession began in New Jersey in January 2008, a month later it started in the U.S. New Jersey’s economy lost 103,200 jobs between January 2008 and January 2009 and the preliminary estimate shows the loss of another 19,700 jobs in February 2009. New Jersey’s loss of 2.9 percent of the national job loss is very slightly less than the 3.0 percent that could be expected based on its share of the national job base. That is, these numbers indicate that the state’s econo- my is doing almost (but not quite) as badly in terms of job declines, as the nation. As the chart also makes clear, New Jersey has now lost almost all the jobs gained during its six and a half year long expansion. In February 2009 the state had only 3,800 jobs more than at its previous trough in mid-2002. We expect the state to lose a total of about 189,000 jobs over the course of the recession, followed by a very weak turnaround in early 2010.

This forecast for New Jersey assumes that the U.S. will experience a five-quarter dip in real gross product (GDP) running through mid-2009 and a period of decreasing employment lasting through early 2010. The U.S. unemployment rate will peak at 10.3 percent in mid-2010.

Our forecast indicates that the recession in New Jersey will not be quite as bad as it is in the nation primar- ily because of the way its economy is structured. The state is less reliant on the goods producing industries than is the U.S. as a whole and the state did not have the enormous run-up in new residential construction that occurred in some of the hardest hit areas of the country. A large proportion of the job losses in the U.S. have been and are likely to be in the manufactur- ing, construction, and financial sectors. New Jersey’s manufacturing sector comprises only 7 percent of the state’s economy compared to 10 percent in the nation. Transportation equipment manufacturing is likely to lose 1.5 million jobs in the U.S. in the next year and a half. But there were only about 6,000 jobs in the industry in New Jersey when the recession began. In the unlikely event that the state lost them all—and it has already lost 1,000 of them—it would mean a direct loss of only 0.2 percent of the employment base. The U.S. has already lost 800,000 construction jobs and is likely to lose at least that many more in the next year or so—a total of about a quarter of its construction job base in 2006. Although New Jersey is also likely to lose about a quarter of its 2006 construction job base during the recession, that base accounted for a smaller part of the employment mix in the state (4 percent) than in the U.S. (5.5 percent). The real problem for New Jersey is like to be the financial sector. The state has a large exposure to the securities industry, which we expect will lose nearly a quarter of its 2007 job base during the recession. Besides New Jersey’s direct exposure to the securities industry it will also feel an impact from the job loss in that industry in New York City, since many employees of the city’s securities in- dustry reside in New Jersey.