News & Events

Rutgers Team to Receive $1 Million in Federal Funding for Smart Kids and Cool Seniors Project

A team of researchers at Rutgers University–New Brunswick has been selected to receive a $1 million Civic Innovation Challenge (CIVIC) award for a community-university partnership that combats climate change and improves access to essential resources and services. CIVIC is organized by the National Science Foundation in two stages. First, teams utilized...

Big retirement payouts for top cops, fire chiefs and school brass cost $76M. Why can’t N.J. stop them?

Despite attempts to cap significant retirement payouts to high-ranking officials in New Jersey, such as police chiefs, fire chiefs, and school administrators since 2010, generous payouts continue, impacting the state’s highest property taxes and diverting funds from other essential services. Since 2020, 780 of the highest-paid government employees in New...

New Report from Marc Pfeiffer – First, Do No Harm: Algorithms, AI, and Digital Product Liability

The relatively recent introduction of publicly accessible artificial intelligence-driven chatbots (e.g., Bard, Bing, ChatGPT, Claude) have focused public attention on the broader individual and societal harms that can result from algorithms that are embedded in digital technology goods and services. The potential for algorithmic harm(s) are commonly...

Atlantic City Housing Authority spent nearly $500K on leadership consultants

ATLANTIC CITY — The Atlantic City Housing Authority spent nearly a half-million dollars on two administrative consultants over the past year and continued to keep them on the payroll through the summer despite the addition of new permanent staff in the same roles... Marc Pfeiffer, a procurement expert and senior policy fellow with Rutgers University’s...

CUPR staff and students meet with Senator Booker to discuss new EPA-funded air quality initiative

CUPR green building colleagues Jen Senick, Clint Andrews, and Gedi Mainelis are part of a new EPA-funded project in Elizabeth, NJ, to install air quality sensors near public housing. US Senator Cory Booker, US Representative Robert Menendez , Union County Commissioner Bette Jane Kowalski, Elizabeth Mayor J. Christian Bolwage, EPA Region 2 Director Lisa...

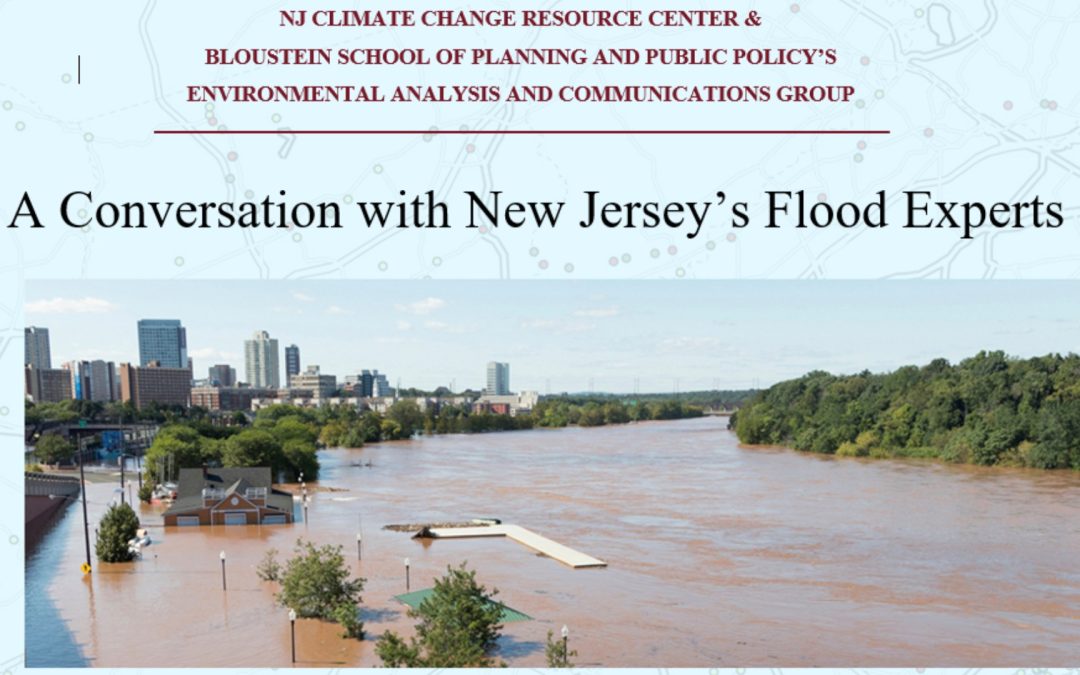

Event: A Conversation with New Jersey’s Flood Experts

A Conversation with New Jersey’s Flood Experts Friday, September 15, 2023, 2pm The New Jersey Climate Change Resource Center and the Rutgers University Bloustein School of Planning and Public Policy’s Environmental Analysis and Communications Group hosted a discussion with flood hazard experts from the New Jersey Department of Environmental Protection. ...

Pfeiffer Op-Ed: What state and local governments should do about generative AI

How can we take advantage of the technology without harming the public? Society is often slow to appreciate that technological innovations have both positive and negative outcomes. Splitting the atom led to weapons that can destroy the planet, but also provided a source of carbon-free energy and health care advances. Social media apps have connected people...

‘Not a perfect process’: How did the two versions of NJ’s budget differ?

As the process to craft New Jersey's state budget came to a chaotic close last month, rumors swirled about what needed to be done to ensure that the spending plan was final and complete by the time it made it to the governor’s desk. In each chamber of the Legislature, late-night committee meetings saw budget bills introduced and read into the record with a...

$3.25M in Grants Awarded to Create Inclusive Healthy Communities in NJ

In partnership with CUPR's Environmental Analysis & Communications Group, led by Executive Director Jeanne Herb, the Inclusive Healthy Communities Initiative of the Division of Disability Services (New Jersey Department of Human Services) funds projects that promote the health and well-being of individuals with disabilities in the communities where...

Bill Dolphin 1945-2023

We mournfully announce the passing of our long-time colleague from CUPR, Mr. William (Bill) Dolphin. He passed away Friday morning June 23, 2023 at 77 years old. David Listokin shared the following reflection: Mr. Dolphin was born in Kearny and graduated from St. Benedict’s Prep High School and St. Peter’s College. He earned a master’s degree in Sociology...

Recent Products

Planning the Built Environment and Land Use Towards Deep Decarbonization of the United States

Many governments, businesses, and institutions are committing to net zero greenhouse gas emissions by 2050, a goal and process known as deep decarbonization. Achieving this goal in the United States requires a national, economy-wide transformation in energy production...

Economic Impacts of Historic Preservation in Florida

This technical study examines the many substantial economic effects of historic preservation in Florida. The study examines the total economic effects of historic preservation; these encompass both the direct and multiplier effects. The direct impact component...

New Jersey 2020 and 2021 Retail Lighting Sales Data Analysis

Apex Analytics, along with Demand Side Analytics, developed an analysis of national lighting sales to assess the relative progress of LED market shares in states with retail lighting programs in comparison to non-program states. This memo describes the data sources...

Route 66, Revisited

In 2011, after many years of study, Rutgers University finished a landmark economic impact analysis of Route 66. Conducted in collaboration with the National Park Service (NPS) and the World Monuments Fund (WMF), The Route 66 Economic Impact Report* worked to capture...